- Home

- Convert To

We can migrate any number of historical years, both single and multi currency entities, customized Chart of Accounts.

This is a full transactional conversion wherein we bring Chart of Accounts, Contact Master, Item Master, Opening Trial Balance, Invoices, Bills, Bank Transactions and Manual Journals.

Xero

Convert historical data from almost any accounting software to Xero

List of Software which we can migrate to Xero

UK (To change the region, please select region from top right section region drop down)

UK (To change the region, please select region from top right section region drop down) Convert from Kashflow

Convert from Kashflow Convert from QuickBooks

Convert from QuickBooks Convert from Sage

Convert from Sage Convert from Twinfield

Convert from Twinfield Convert from TAS

Convert from TAS Convert from QBO

Convert from QBO Convert from FreeAgent

Convert from FreeAgent Convert from Clearbooks

Convert from Clearbooks Convert from Sage One

Convert from Sage One Convert from FirstBooks

Convert from FirstBooks Convert from Access Dimension

Convert from Access Dimension Convert from MoneyWorks

Convert from MoneyWorks Convert from Crunch

Convert from Crunch Convert from Exact

Convert from Exact Convert from VT Accounts

Convert from VT Accounts Convert from Gnu Cash

Convert from Gnu Cash Convert from Pandle

Convert from Pandle Convert from Aqilla

Convert from Aqilla Convert from Accounts Portal

Convert from Accounts Portal Convert from Xero

Convert from Xero Convert from QuickFile

Convert from QuickFile Convert from Wave

Convert from Wave Convert from Any Other Software

Convert from Any Other Software

QBO

Convert historical data from almost any accounting software to QBO

MYOB Business

Convert historical data from almost any accounting software to MYOB Business

Reckon

Convert historical data from almost any accounting software to Reckon

FreshBooks

Convert historical data from almost any accounting software to FreshBooks

FreeAgent

Convert historical data from almost any accounting software to FreeAgent

ClearBooks

Convert historical data from almost any accounting software to ClearBooks

- FAQ

MYOB

FreeAgent

List of Software which we can migrate to FreeAgent

FreshBooks

Xero

QBO

ClearBooks

- Order

- Team

- Career

- Contact Us

- Get a Quote

- Convert PDF Statement

- Test Migration

- Region

FAQ - MYOB to QBO Conversion

Home FAQ-MYOB to QBOMyob To Quickbooks online Conversion - Getting your accounting data from MYOB (or any other accounting software) into the cloud is a challenge, but it doesn't have to be a nightmare!

If you're looking for a QuickBooks data conversion service, then look no further! Our team can help you get your data migrated quickly and painlessly. We can extract data from any accounting program and format it to work in QuickBooks Online, Desktop or even your set of QuickBooks Accountant Desktop files, if necessary.

If you've moved from MYOB to QuickBooks, we can help get your data migrated accurately and easily, with a high degree of accuracy. We can convert and migrate your data into any version (including 2016, 2013, and earlier), and we're confident that you'll be happy with the results!

Steps to Convert data from MYOB to QBO.

If you're looking to convert your data from MYOB to QuickBooks, there are a few simple steps you can take to ensure a smooth and easy transition.

- Make sure you have a current backup of your MYOB data. This is essential in case something goes wrong during the migration process.

- Click Convert Now button on the home screen and follow on-screen instructions. This tool will help you extract your data from MYOB and format it for QuickBooks Online

- Upload your converted data file into QuickBooks Online. Once you've completed the migration, you can start using your new accounting software immediately!

Our team of experts can perform the migration quickly, accurately and affordably so that you don't have to worry about any of the headaches involved in this task. Plus, if there are issues or questions during the process we will help resolve them at no additional cost to you!

- Chart of Accounts(We do custom mapping as well)

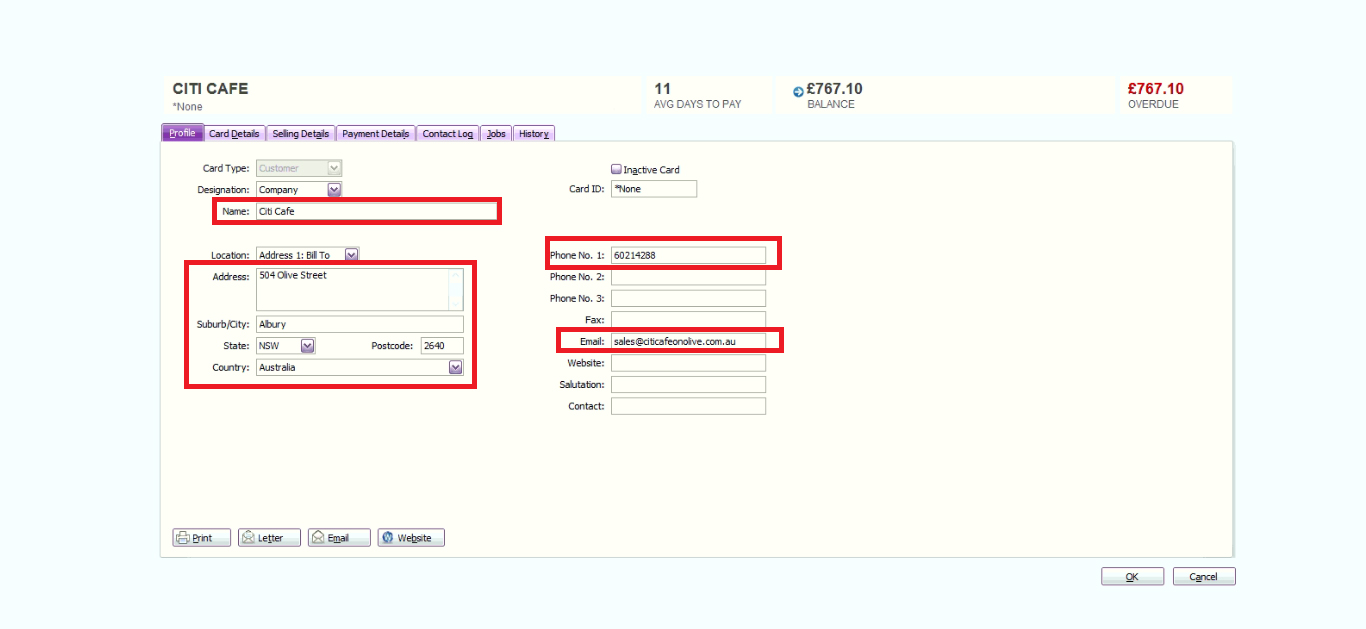

- Customer Details

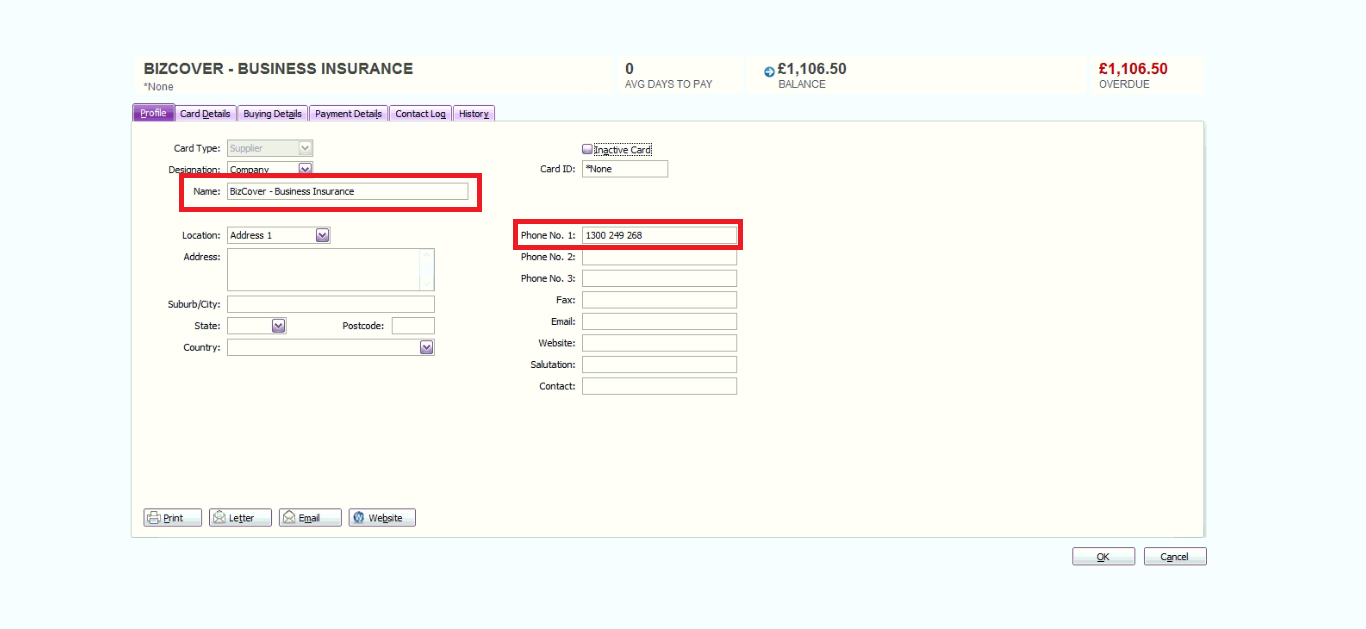

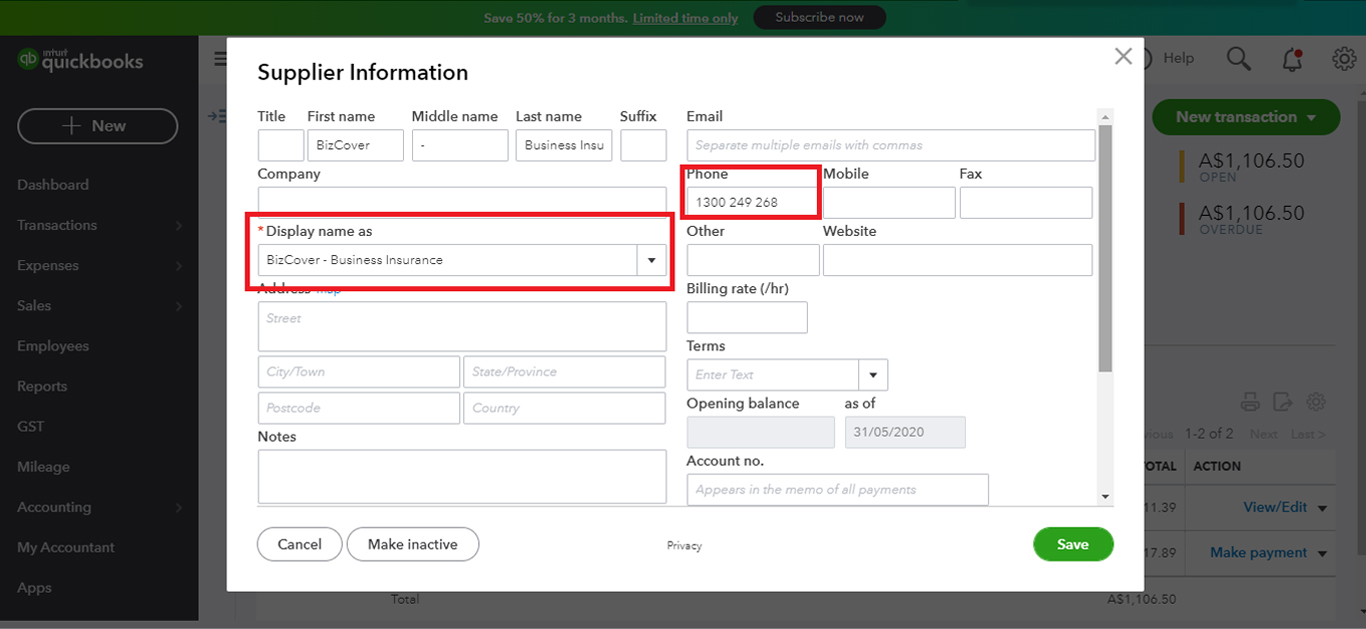

- Supplier Details

- Opening Account Balances

- Aged Receivables

- Aged Payables

- Classes

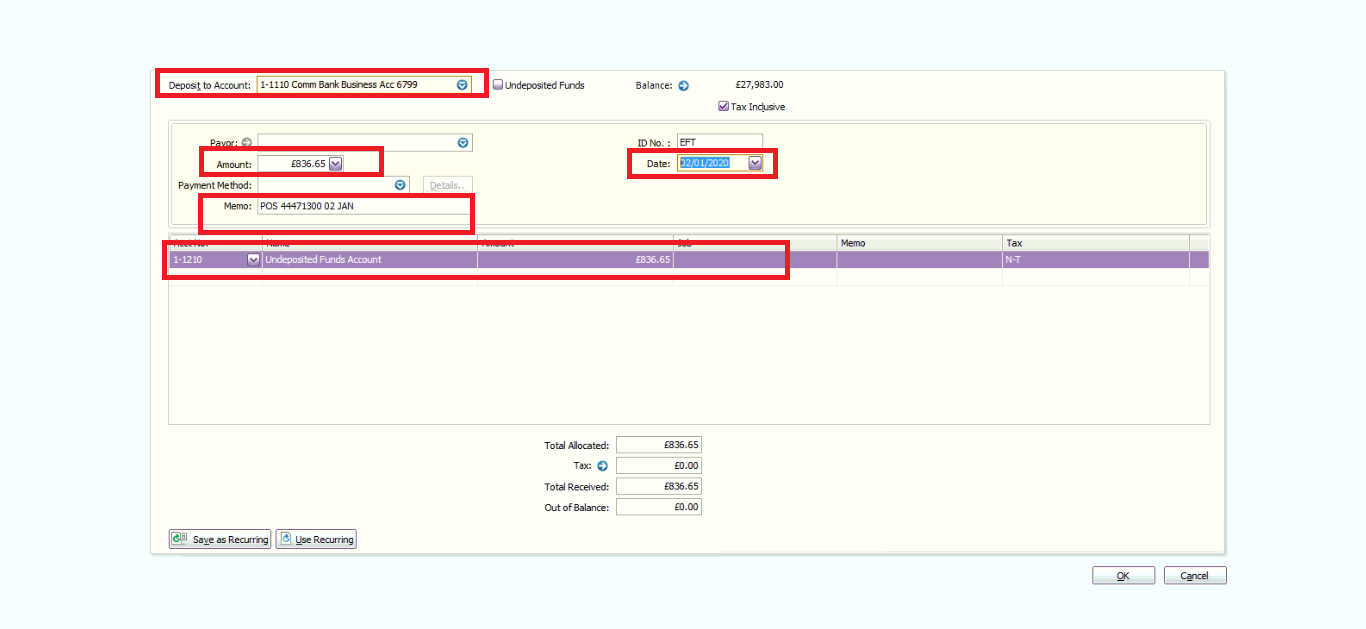

- Bank Transactions (Includes Invoice payments, Bill payments, and other Bank Transactions) (All Bank Transactions will remain unreconciled in QBO and can be reconciled at your end at once by entering opening balance and closing balance. This will be the step in the post-conversion process at your end)

- Credit Card (converted as QBO Bank Accounts)

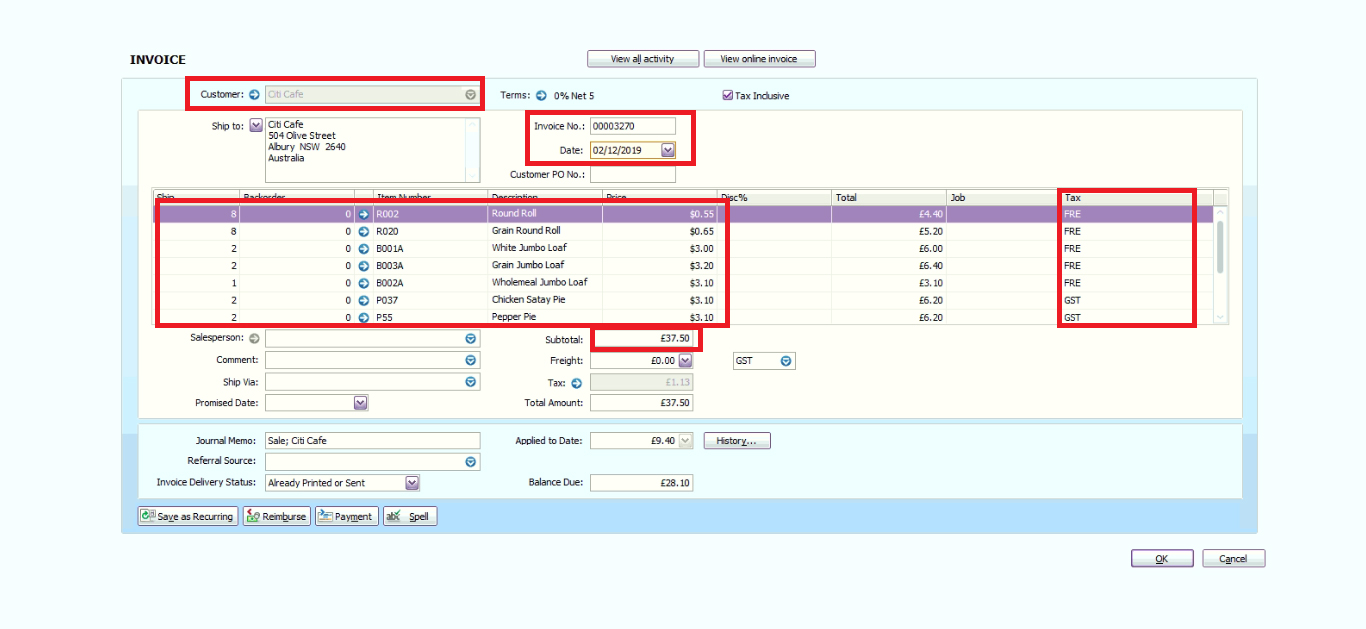

- Invoices and Credit Notes Detailed

- Bills and Bill credit Detailed

- All Manual Journals

- Inactive Contacts/Accounts can be brought over on special request

- Wine Equalisation Tax (WET)

- The entire conversion and matching of Reports are done on ACCRUAL Basis.

- Allocation of Invoices or Bills against credit notes

- We make our best attempt to give you the exact image of your MYOB data, however, due to the limitations of few fields which are different in MYOB and QBO, we might have to use some workarounds to bring the transactions.

- Expense Claims

- Tracked Inventory

- Payment Terms

- Deleted/Void Transactions

- Transaction lines with Nil Values

- Individual Pay Runs for the conversion period

- Sales Rep

- Customer Jobs

- Attachments

- Unreconciled Transactions

- Allocation of Invoices or Bills against credit notes

- We are specialist in converting core financial information and we try our best to bring the other non-financial information as well, however, because of the limitation of APIs of both software’s, we might not be able to get few fields

- Chart of Accounts - Sub Accounts in MYOB are converted as Independent Accounts in QBO

- Chart of Accounts - Inactive Accounts, if used in MYOB in the conversion period are turned as Active Accounts in QBO

- Open Receivable and Payable Invoices shall contain only single line showing the unpaid balance of Invoice in QBO

- Custom Sales Tax Rates are converted into standard Sales Tax Rate with "Tax Adjustment" entry as a separate line item in QBO

- Inter Bank Transfers may be converted through a Clearing Account in QBO

- System Accounts like Retained Earnings, VAT control Account are used in QBO for their counterpart accounts in MYOB

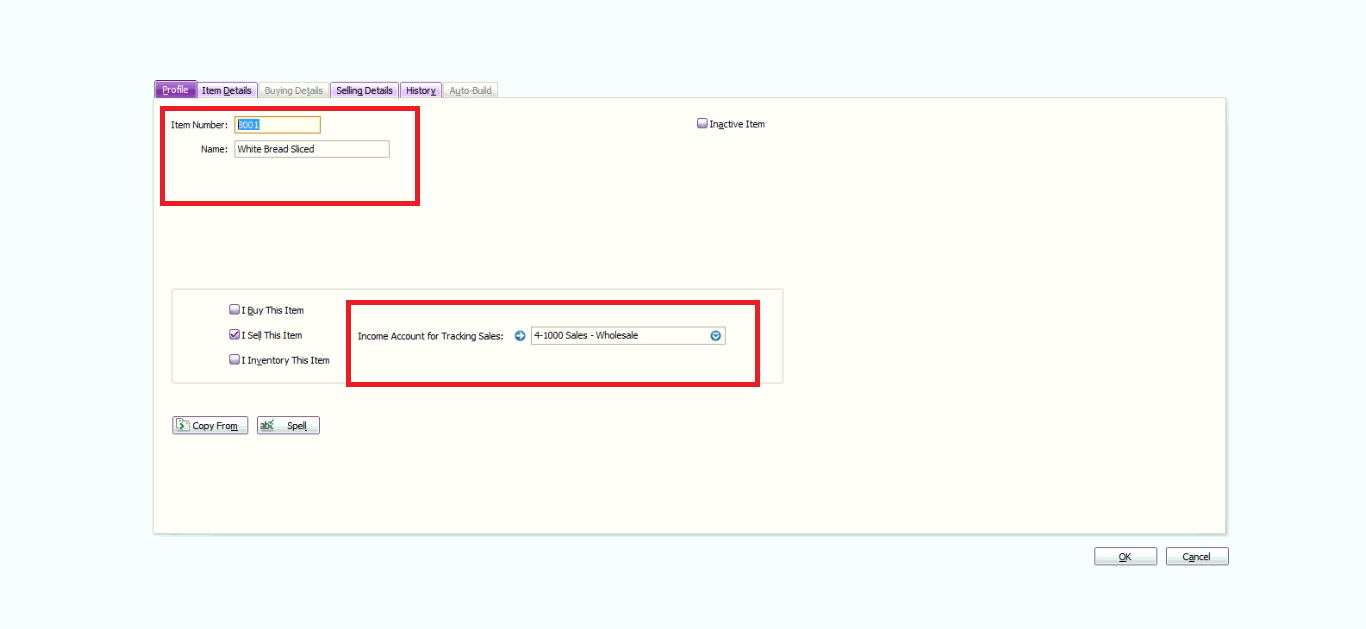

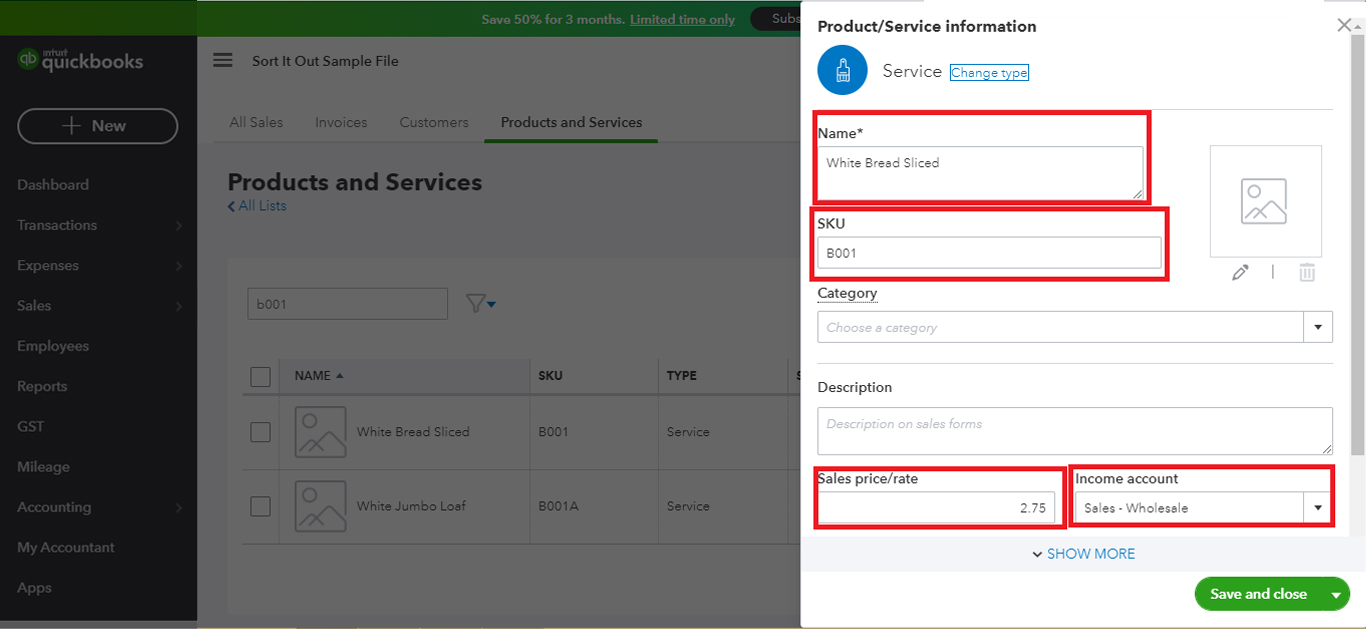

- We bring inventory details like name, code, description, sales account, purchase account, sales price, purchase price etc. Since we don’t do tracked inventory, as part of the migration, we import all the items as "non-inventory" type in QBO and after the completion of the migration, you need to manually change the type from 'Non-Inventory' to 'Inventory' and add the quantity on hand manually for each item

- We bring Wine Equalisation Tax (WET) by adding a description line item to the invoices having WET. Please note that we do not bring WET as a Tax Type.

- In multi-currency files, while feeding the opening balances on the conversion date, QBO would use the same exchange rate for the conversion date for all the multi-currency accounts. This might cause a difference in the debit and credit side of the trial balance.

- Rounding can be different in QBO and MYOB because of the data precision techniques used in both software.

- Blank Bill reference Numbers and Invoice reference Numbers:- In case we find any invoice or bill without a number, we use a dummy number example for Bills:- Bill1, Bill2 and for Invoices - Inv1, Inv2.

- Duplicate reference Number in bank transactions or invoices/bills:- In case we find duplicate reference numbers then we use transaction numbers instead of reference numbers or make the numbers unique by appending an extra character with a hyphen

- Limitation of Reference number:- QBO have limitations of 20 characters for Reference number thus for the reference numbers more than 20 characters we have to trim them to 20 characters.

- Multi-Currency Transactions (brought over in same currency as they were fed in MYOB, same exchange rate as it was fed in MYOB)

- Total Accounts Receivable in QBO shall not exactly match the Total Accounts Receivable in MYOB because of the different exchange rates used in QBO

Total Accounts Payable in QBO shall not exactly match the Total Accounts Payable in MYOB because of the different exchange rates used in QBO.

MYOB CUSTOMER

QBO CUSTOMER

MYOB SUPPLIER

QBO SUPPLIER

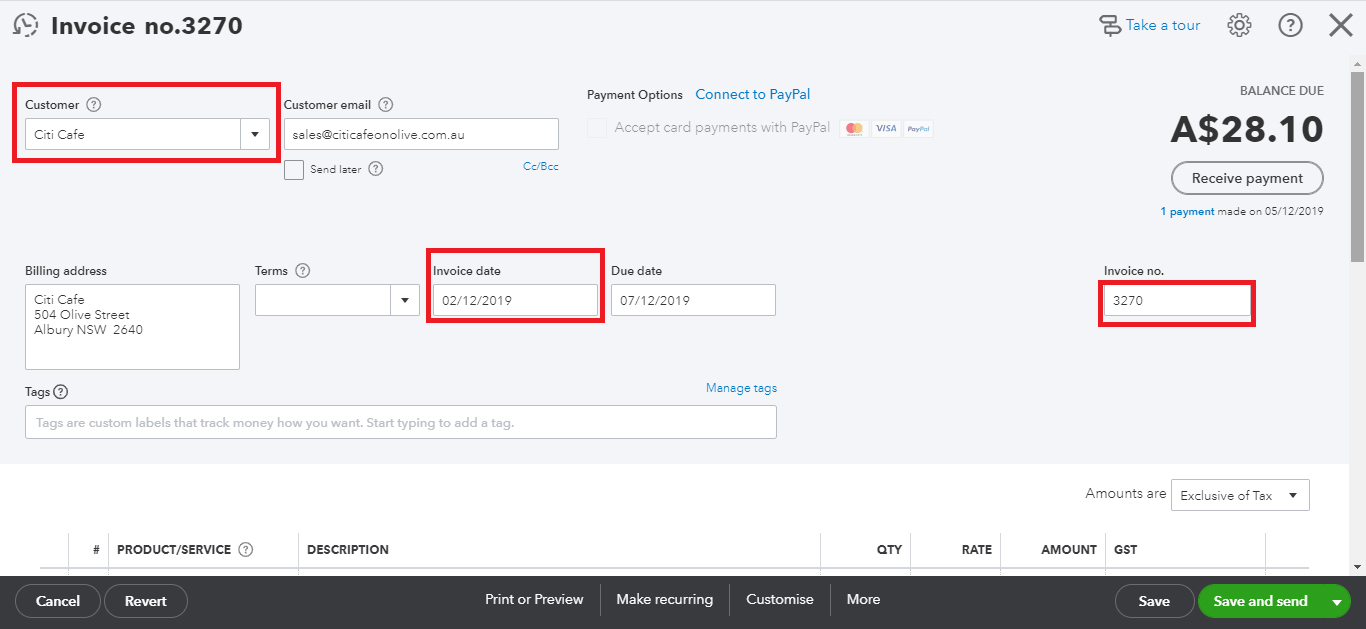

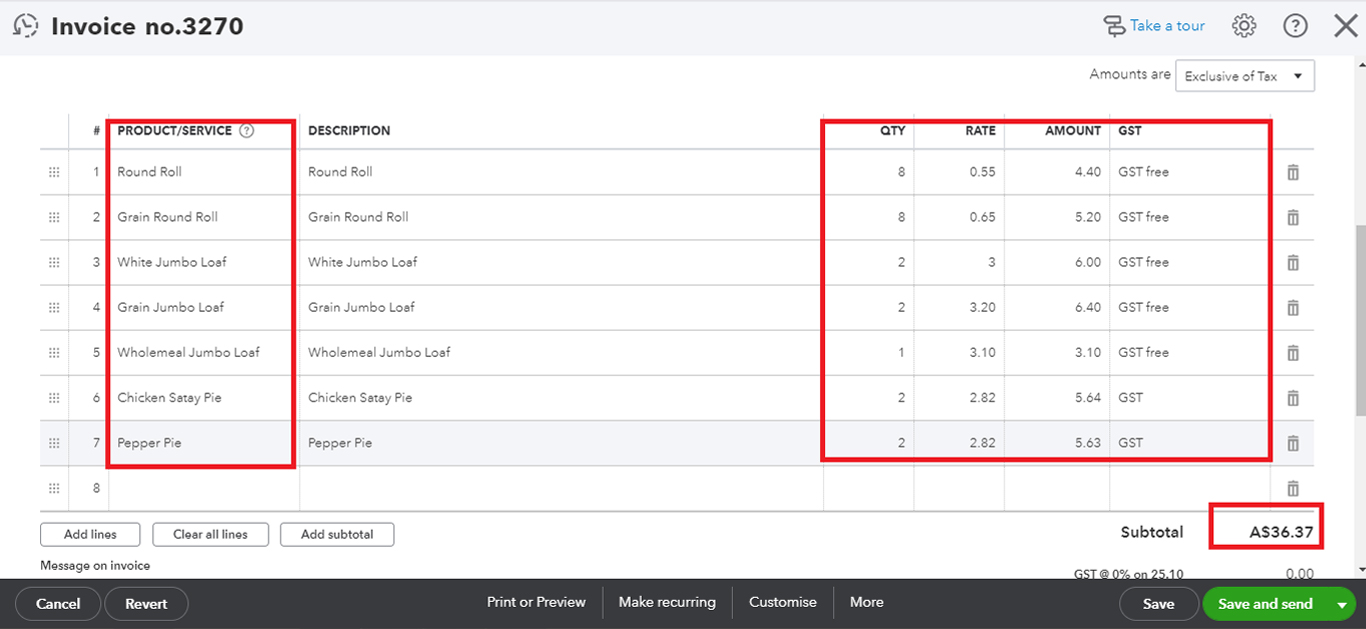

MYOB INVOICE

QBO INVOICE

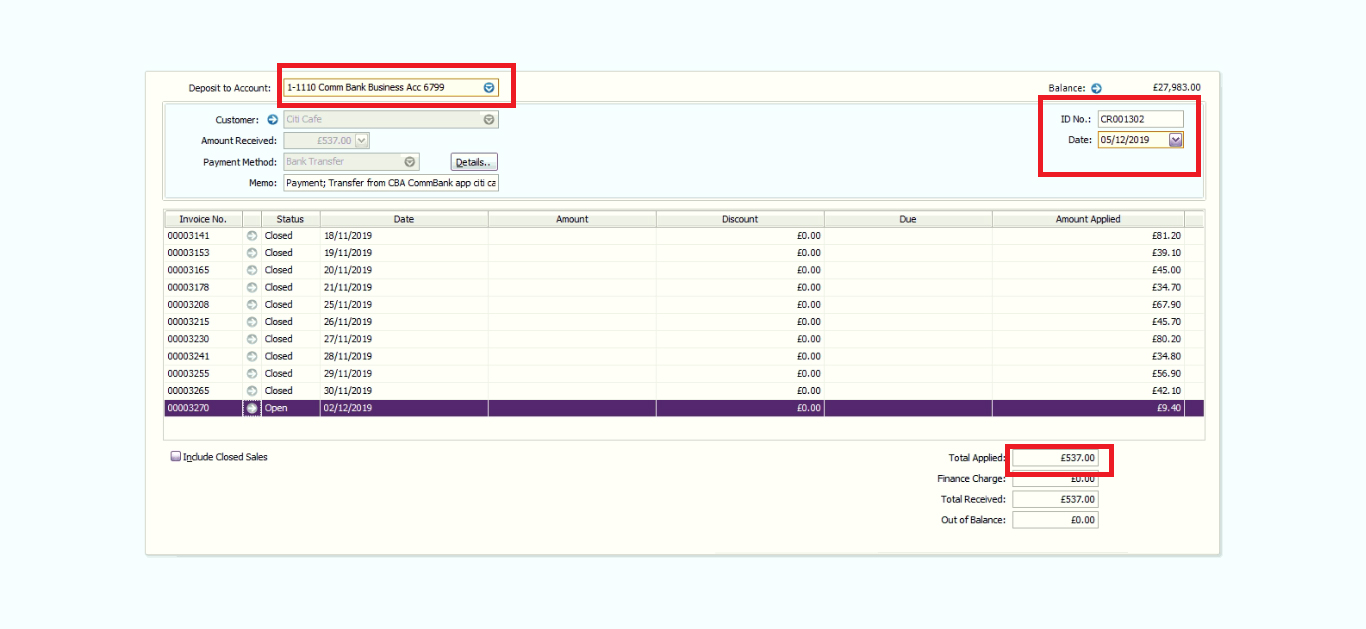

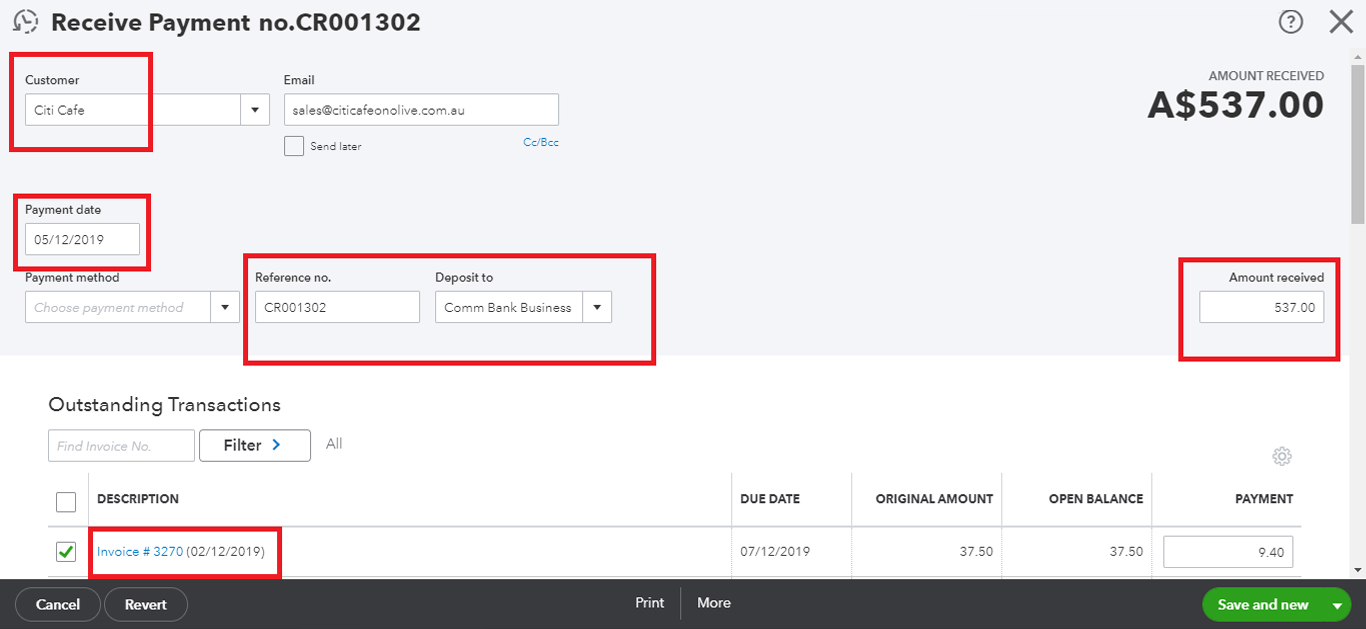

MYOB INVOICE PAYMENT

QBO INVOICE PAYMENT

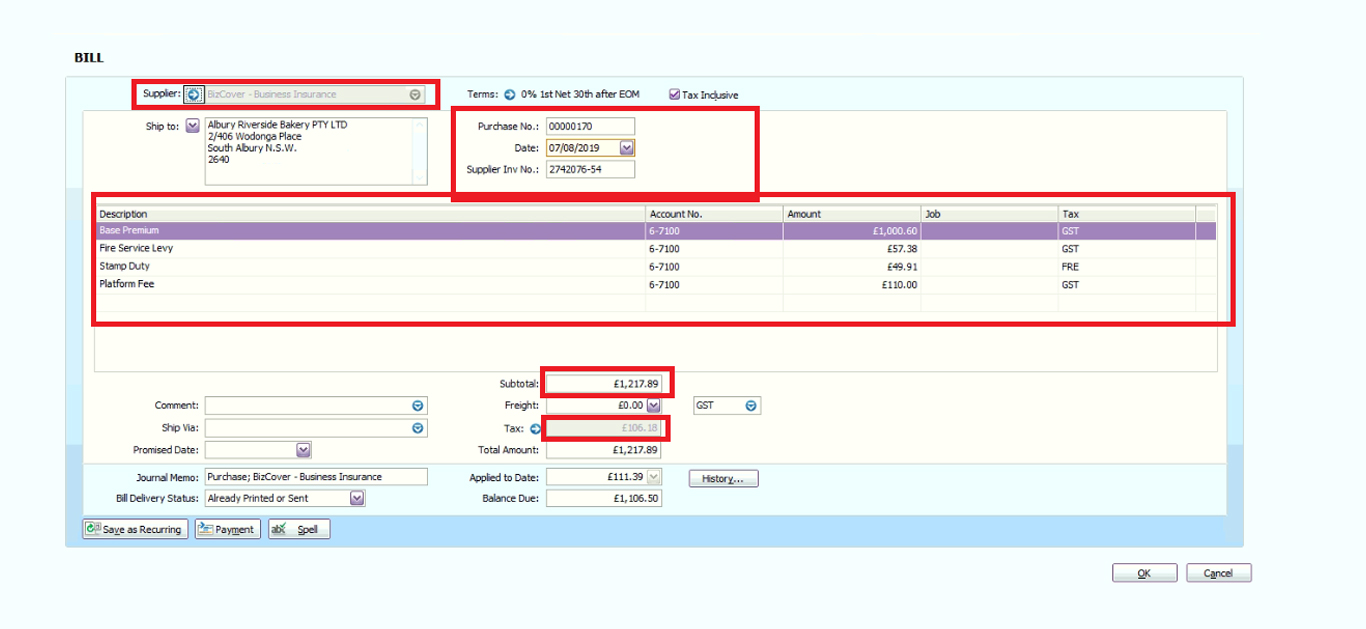

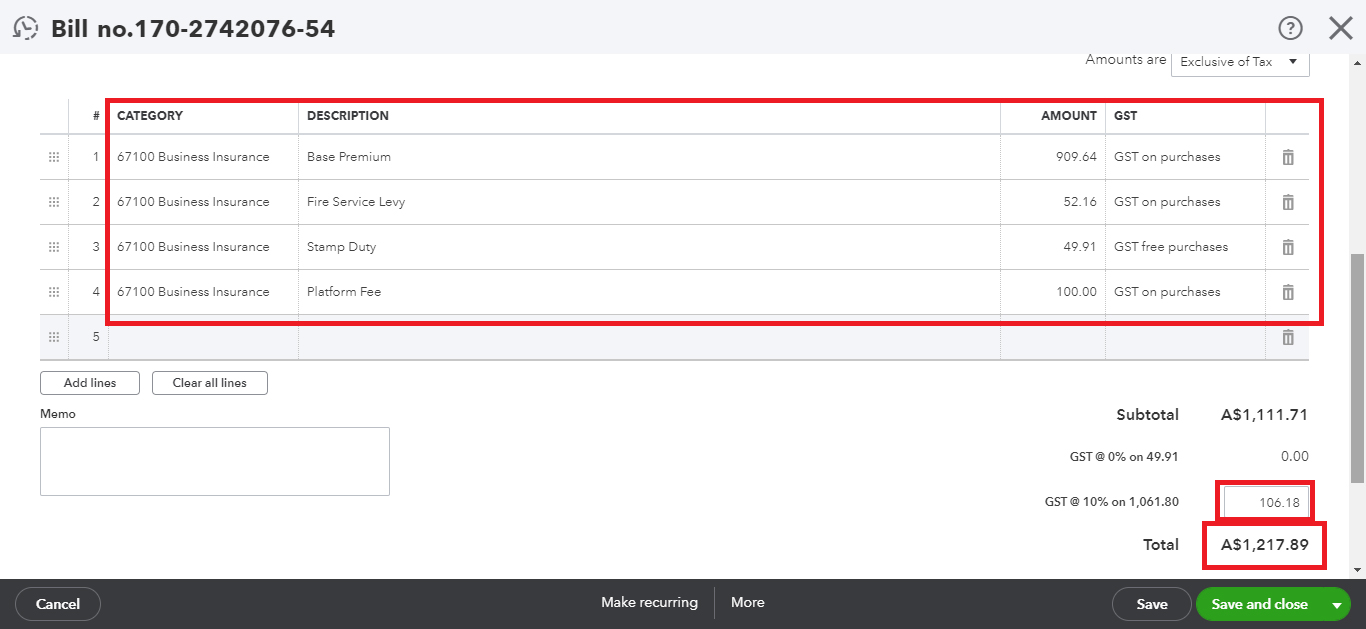

MYOB BILL

QBO BILL

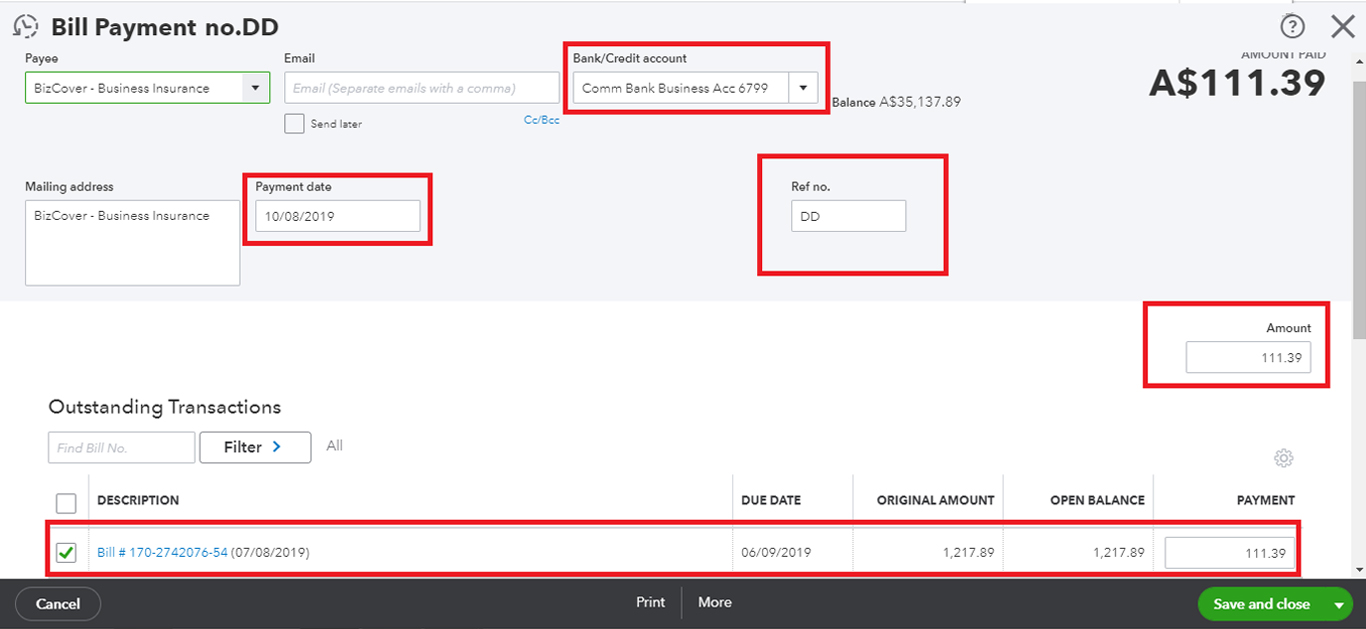

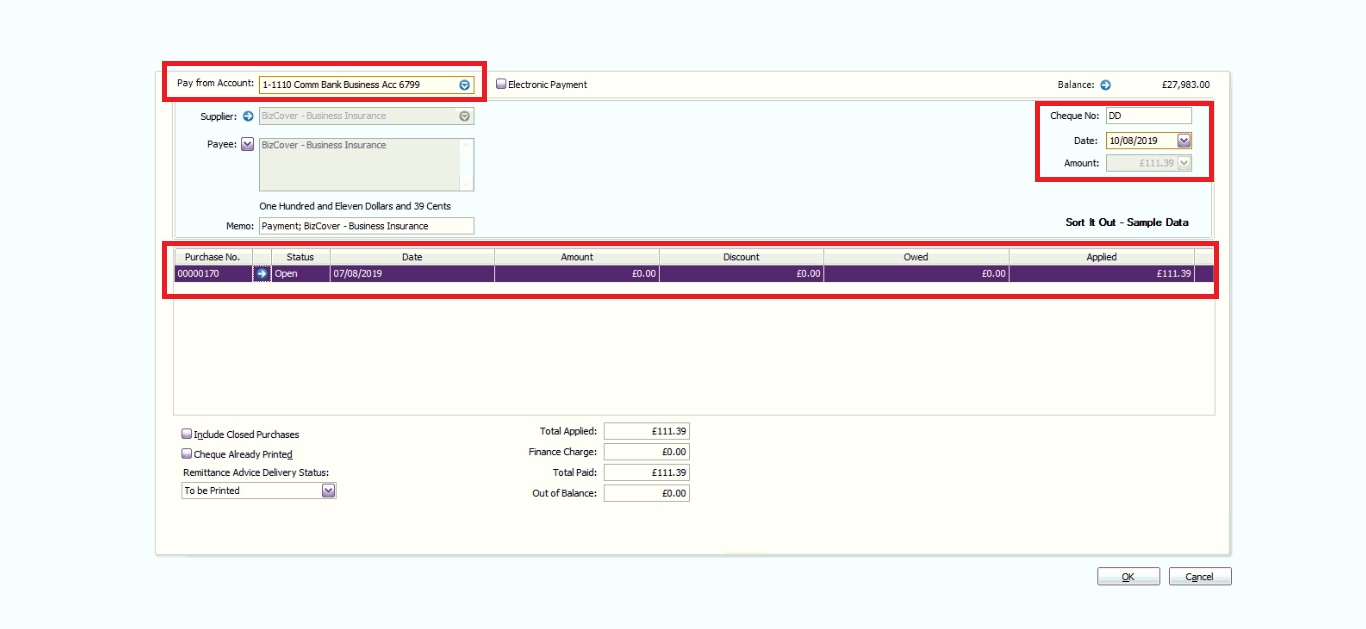

MYOB BILL PAYMENT

QBO BILL PAYMENT

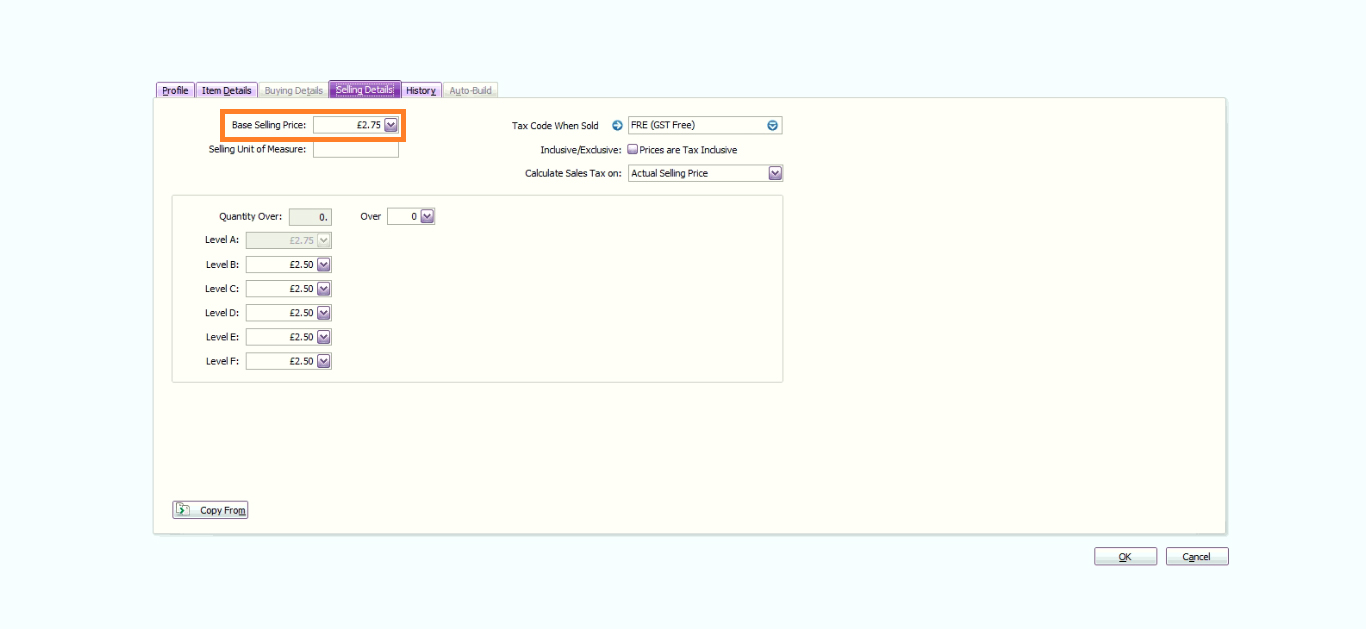

MYOB ITEM

QBO ITEM

MYOB TRANSFER

QBO TRANSFER

What makes us Special?

Historical Years of Conversion

We convert the full previous years to date. Get a complete mirror image of your financial data including previous years.Payroll

All transactions and payroll are setup so you can pick up where you left off.Timely Execution

We've done our best to make sure that we timely deliver converted data.Constantly improving

We are always trying to improve the service we deliver to our customers.Customized Conversions

Just ask and we deliver. Data conversion can be customized depending on your requirement.Multi Currency

We bring over multi currency transactions in the same foreign currency at the same exchange rate as fed in the source software.What Our Customers Say

Read All...Telgavati SubramanyamDirector, First Idea Training Solutions

We are highly recommend MMC Convert and the great service the provide. Excellent service and 5 year data moved from MYOB to QBO. Satisfactory data migration achieved.

Rob CheesmanDirector, Kettering Professional Services

We used MMC for two Reckon conversions. One in Australia and one in New Zealand. Both had multi currency and one had payroll. We were very happy with the work done and especially how good the communication was. Highly recommend them.

Erica ChapmanDirector, Skyline Business Solutions

Great company to work with, fast turnaround and good communication. I had them do a conversion from Xero to QBO that another company failed to do. Their team was quick to complete it and it was accurate! Highly recommended.

Brian SchmittCo-Founder, SureFoot

"MMC converted us from Wave to Xero. Our data in Wave was apparently a little unusual, but after a couple emails MMC had us totally setup and running in Xero w/ all our past data from Wave! I would definitely use them again."

Sharon ChapmanManager at RMY Clements

Ankit has always been quick, efficient and very helpful when converting companies for us (2 so far) from Sage One to QuickBooks so I would have no hesitation recommending MMC Convert.

Our Conversion Packages

Basic

£129GBPFIXED- Chart of Accounts

- Conversion date balances

- One Historical Year+ Current Year to Date Transactions

- All open receivables

- All open payables

- All contacts (Customers, Suppliers & Employees)

Full Transactional

£189GBPFIXED- Chart of accounts

- Previous FY balances

- One Historical Year + Current Year to Date Transactions

- All receivables

- All payables

- All contacts (Customers, Suppliers & Employees)

We can go back historically for any number of years at an additional price of £69 GBP per year

*We do full bank reconciliations as fed in your previous software

How It Works We Convert your data file with few simple steps.

- Step1Load File

- Step2Select Service & Provide Details

- Step3Make Payment

- Approve QuotationStep4Leave file with MMC

- Step5Receive Subscription Transfer

Our Offices

- USA 1250 N Lasalle Street Chicago. 60610, USA

- AUSTRALIA Level 1, 1034 Dandenong Rd Carnegie, VIC 3163, Australia

- UK Babel Studios 82 Southwark, Bridge Road, London

- Dubai PO Box 56754 Dubai, UAE

- India 11/5, SOUTH TUKOGANI, Indore, India